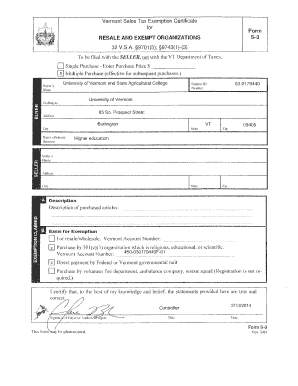

vermont state tax exempt form

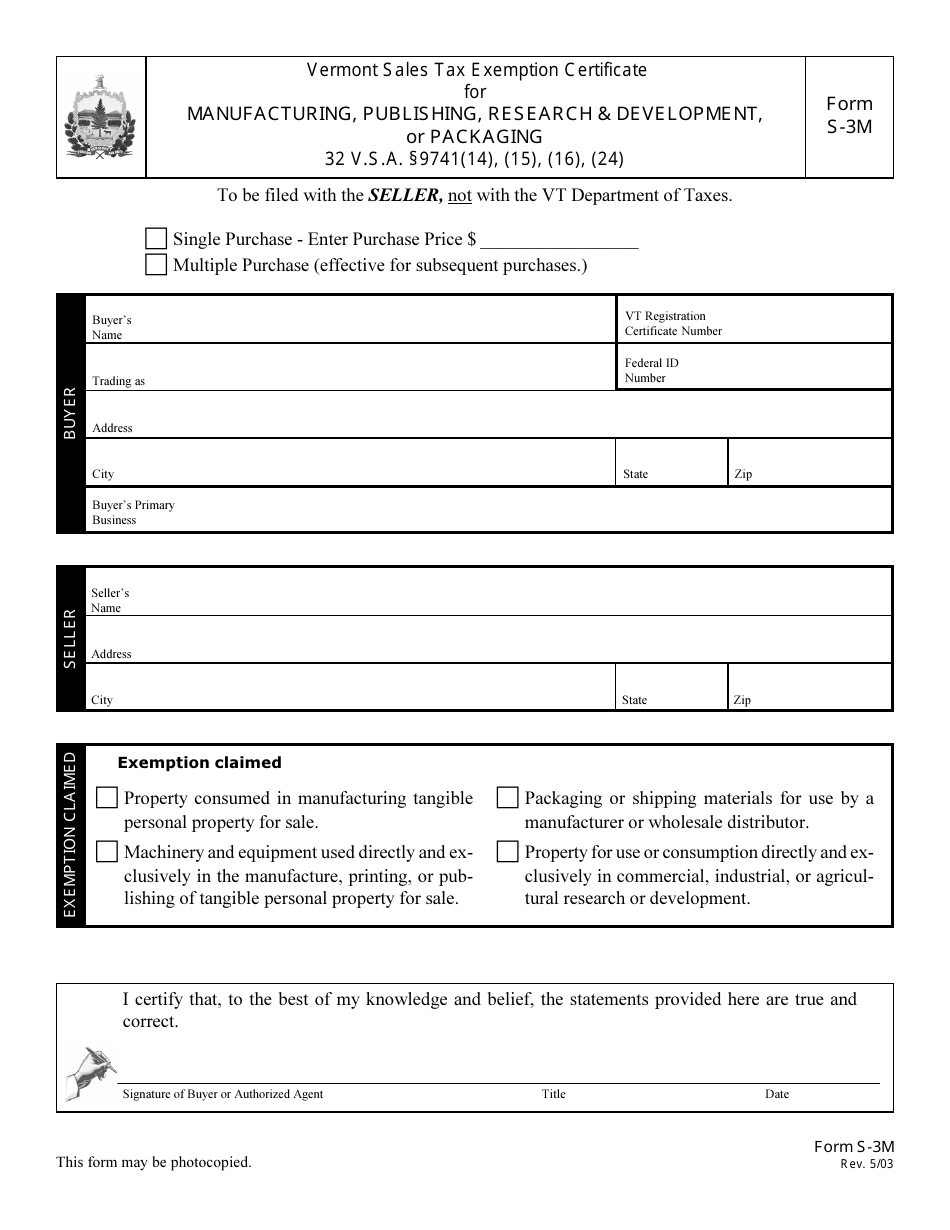

Ad Download or Email VT S-3M More Fillable Forms Register and Subscribe Now. Form 29 Application for Exclusion from Provisions of the Workers Comp Act rev 2-13.

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Certain states require forms for CBA purchase cards and CBA travel cards.

. The certificate is signed dated and complete all applicable sections and fields completed. The property purchased is of a type ordinarily used for the stated purpose or the exempt use is explained. W-4VT Employees Withholding Allowance Certificate.

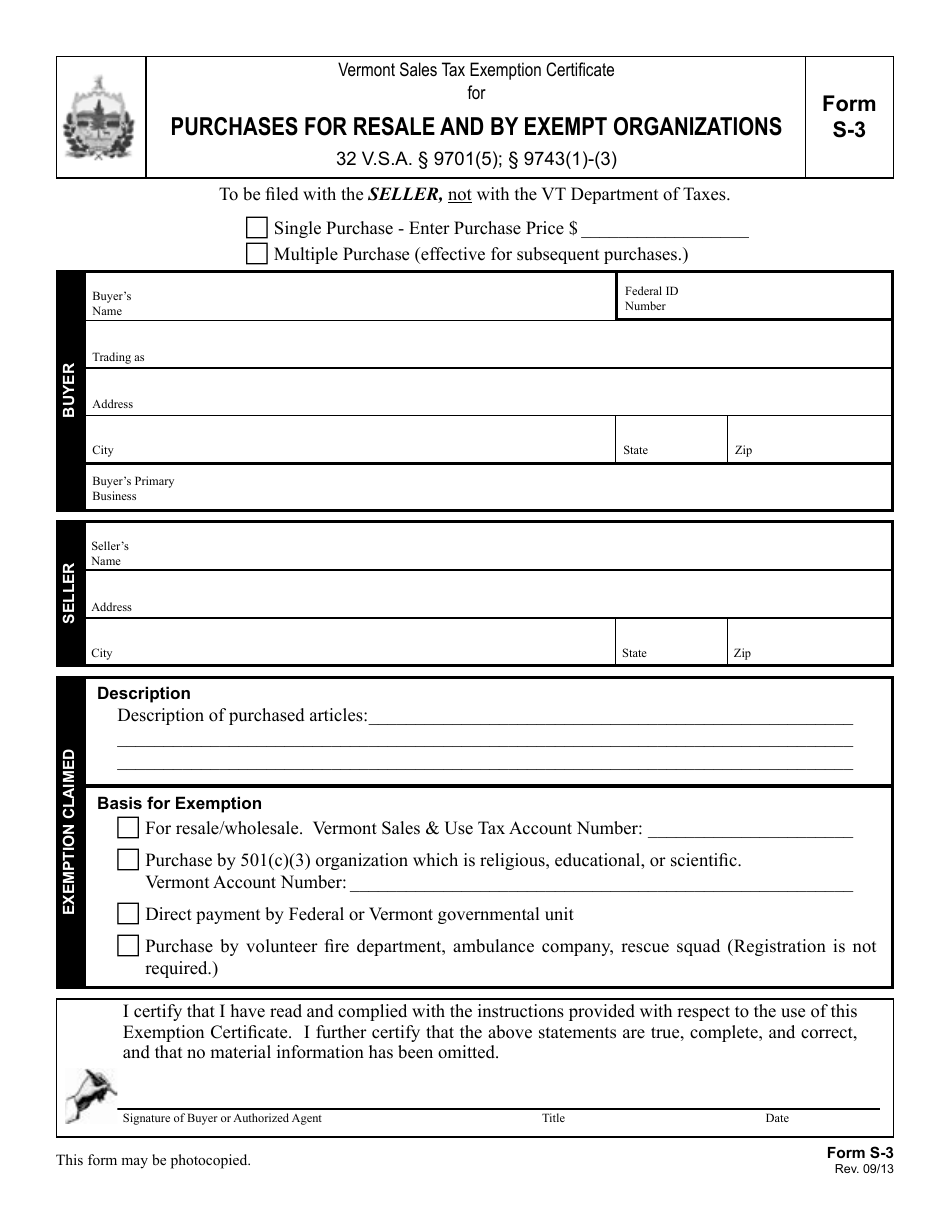

PA-1 Special Power of Attorney. 53 rows Present completed VT Resale and Exempt Organization Certificate of Exemption VT. The level of the exemption varies from 10000 - 40000.

GSA-FAR 48 CFR 53229. When you use a Government Purchase Card GPC Click to define. B-2 Notice of Change.

IN-111 Vermont Income Tax Return. All Forms and Instructions. Standard Contract for Services 12-12-2018 - Revised.

97413 974125 Form S-3A. The exemption reduces the appraised value of the home prior to the assessment of taxes. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

June 16 2021. A copy of Exemption Organization Registration Certificate for Vermont Sales and Use Tax or a letter from the Vermont Department of Taxes signed by the Tax Department stating that the organization has been granted exemption status from Vermont Sales and Use Tax as having 501 c 3 status. A motor vehicle may be exempt from taxation if it is a gift or inheritance as defined under 32 VSA 8911 8.

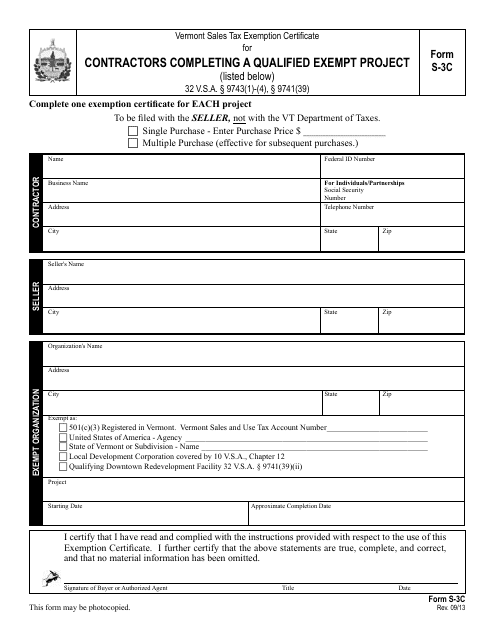

97431-4 944139 Form S-3C ˇ. An eligible veteran lives in a home valued at 200000. If a Gift Tax Exemption claim is submitted with a registration or title and tax application that lists a lienholder the.

The certification is on an exemption form issued by the Vermont Department of Taxes or a form with substantially identical language. VT-013-Gift_Tax_Exemptionpdf 20754 KB File Format. SF1094 United States Tax Exemption Form.

Ii the Maximum Amount is more than. Standard Short Form 12122018 Revised. Farms Farmsude incl enterprises using land and improvements for agricultural production for sale.

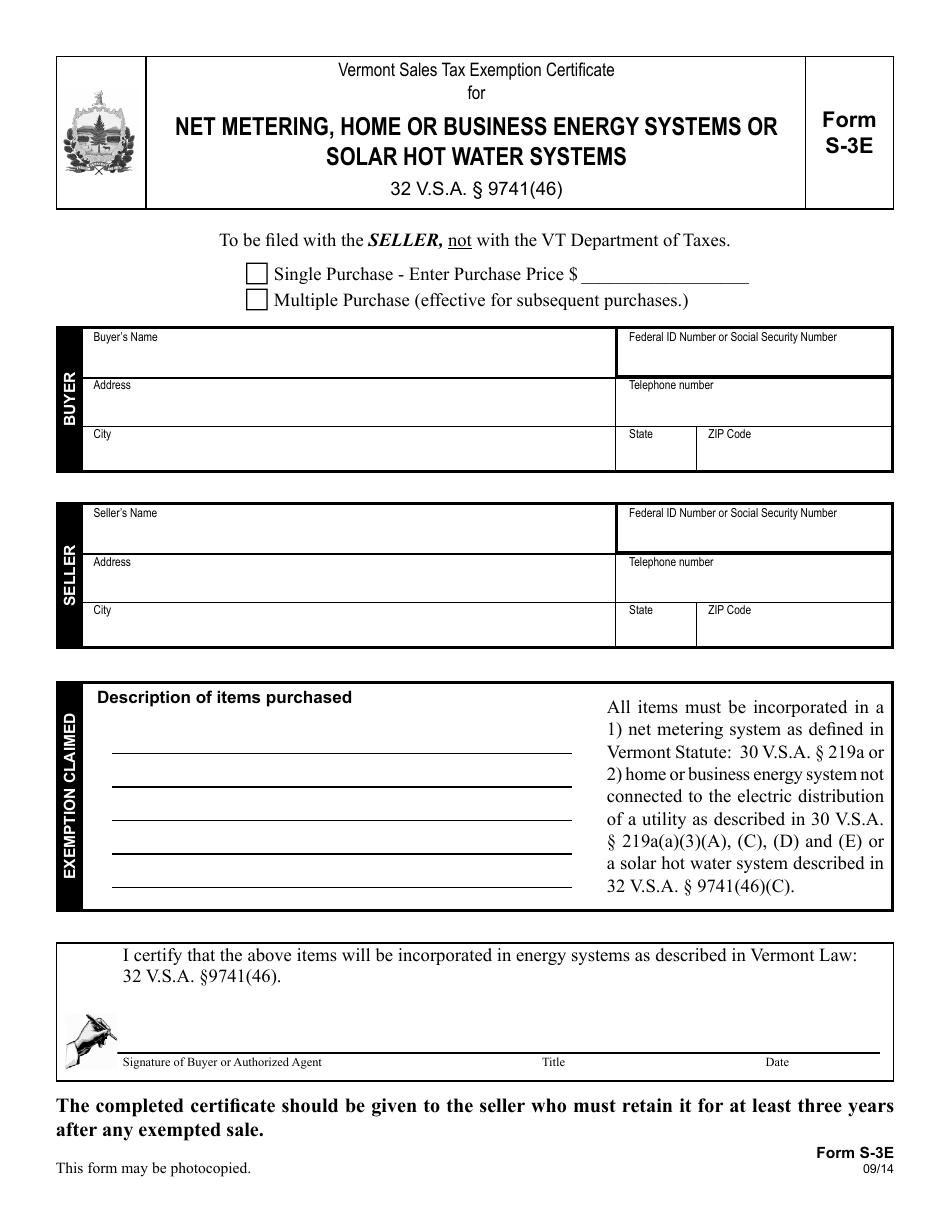

PROPERTY TAX EXEMPTION FOR DISABLED VETERANS AND THEIR SURVIVORS The State of Vermont offers a property tax discount reduction on the assessed value of the primary residence of a 50 or more disabled veteran as rated by the Federal VA and their survivors. 604 The completed certificate should be given to the seller who must retain it for at least three years after any exempted sale. Vermont Department of Health Created Date.

Vermont Department of Motor Vehicles 120 State Street Montpelier VT 05603-0001. The veterans town provides a 20000 exemption. State Tax Exemption Information for Government Charge Cards.

Form S-3F Vermont Sales Tax Exemption Certificate for Fuel or Electricity isompleted c if the use is not obvious or if only a portion of the fuel purchased is exempt. 120 State Street Montpelier Vermont 05603-0001. Fact Sheets and Guides.

State law mandates a minimum 10000 exemption although towns are given the option of increasing the exemption to 40000. The property purchased is of a type ordinarily used for the stated purpose or the exempt use is explained. Ad Download Or Email Form S-3 More Fillable Forms Register and Subscribe Now.

Such as the GSA SmartPay travel card for business travel your lodging and rental car costs may be exempt from state sales tax. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Make Model Year YYYY.

Vermont Sales Tax Exemption Certificate for CONTRACTORS 32 VSA. Use of this Short Form is not authorized and the Standard State Contract Form must be used if any of the following apply. Vermont School District Codes.

Of the conditions outlined on this form must be met to qualify for a tax exemptionIf not tax is due at time of. 2022 2023 Religious Exemption Form Childcare and K-12 Author. Form S3 Resale and Exempt Organization Certificate of Exemption is not.

Sign Up for myVTax. I the Contract Term is more than 12 months. How to use sales tax exemption certificates in Vermont.

Centrally Billed Account CBA cards are exempt from state taxes in EVERY state. The certificate is signed dated and complete all applicable sections and fields completed. Friday May 24 2019.

Form S-3F can be found on our website at wwwtaxvermontgov. The certification is on an exemption form issued by the Vermont Department of Taxes or a form with substantially identical language. Vermont Sales and Use Tax Account Number c United States of America - Agency c State of Vermont or Subdivision - Name c Local Development Corporation covered by 10 V.

Ad Download Or Email Form S-3C More Fillable Forms Register and Subscribe Now. The certification is on an exemption form issued by the Vermont Department of Taxes or a form with substantially identical language. This form may be photocopied.

Download Or Email Form S-3C More Fillable Forms Register and Subscribe Now. Standard Contract form template for Services. Get And Sign Fillable Vermont Sales And Use Certificate 2013-2021 Form.

Form 29 Application for Exclusion from. To request exemption of tax based upon gift when a vehicle was previously registered andor titled by the donor and is gifted with no money exchange and no current lienholder to be listed to a family member as defined acceptable by this form. Vermont Sales Tax Exemption Certificate for AGRICULTURAL FERTILIZERS PESTICIDES MACHINERY EQUIPMENT 32 VSA.

Zip SELLER Seller s Name Organization s Name EXEMPT ORGANIZATION Exempt as c 501 c 3 Registered in Vermont.

Cpa Exam Tips Cpa Exam Cpa Exam Motivation Exams Tips

Fiscal Sponsorship For Nonprofits Sponsorship Levels Nonprofit Startup Sponsorship Proposal

State W 4 Form Detailed Withholding Forms By State Chart

Printable Vermont Sales Tax Exemption Certificates

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Vt Form S 3m Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Manufacturing Publishing Research Development Or Packaging Vermont Templateroller

Open Enrollment 2018 Who What Where When Why Health Snacks Easy Healthy Work Snacks Nutritional Cleansing

Sales Tax Exemption For Building Materials Used In State Construction Projects

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Vt Form S 3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

Notary Public Address Change Notary Public Notary Public

State W 4 Form Detailed Withholding Forms By State Chart

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age